Loan Information

The IWRB is authorized to award loans for the financing of water projects. The term of the loan can range from 5 to 30 years with the average term of 10 to 15 years. The term of the loan varies depending on the amount borrowed, the scope of the project, the ability of the borrower to repay the loan, and the length of time the borrower requests.

Interest Rates

Rates are set in accordance with the U.S 30 Year Treasury Yield (US30Y), plus an additional 0.5%, on the first day of each quarter. Rates are assigned to each loan based on the date a completed application is received.

Water Project Loan Forms

Contact

Justin Ferguson | Loan Program Manager

Phone: (208) 287-4906

Current Loan Rate (Q3): 4.9%

Completed forms may be submitted by:

E-mail: IWRBloans@idwr.idaho.gov

Fax: (208) 287-6700

Mail: PO Box 83720 | Boise, ID 83720-0098

Project Profiles

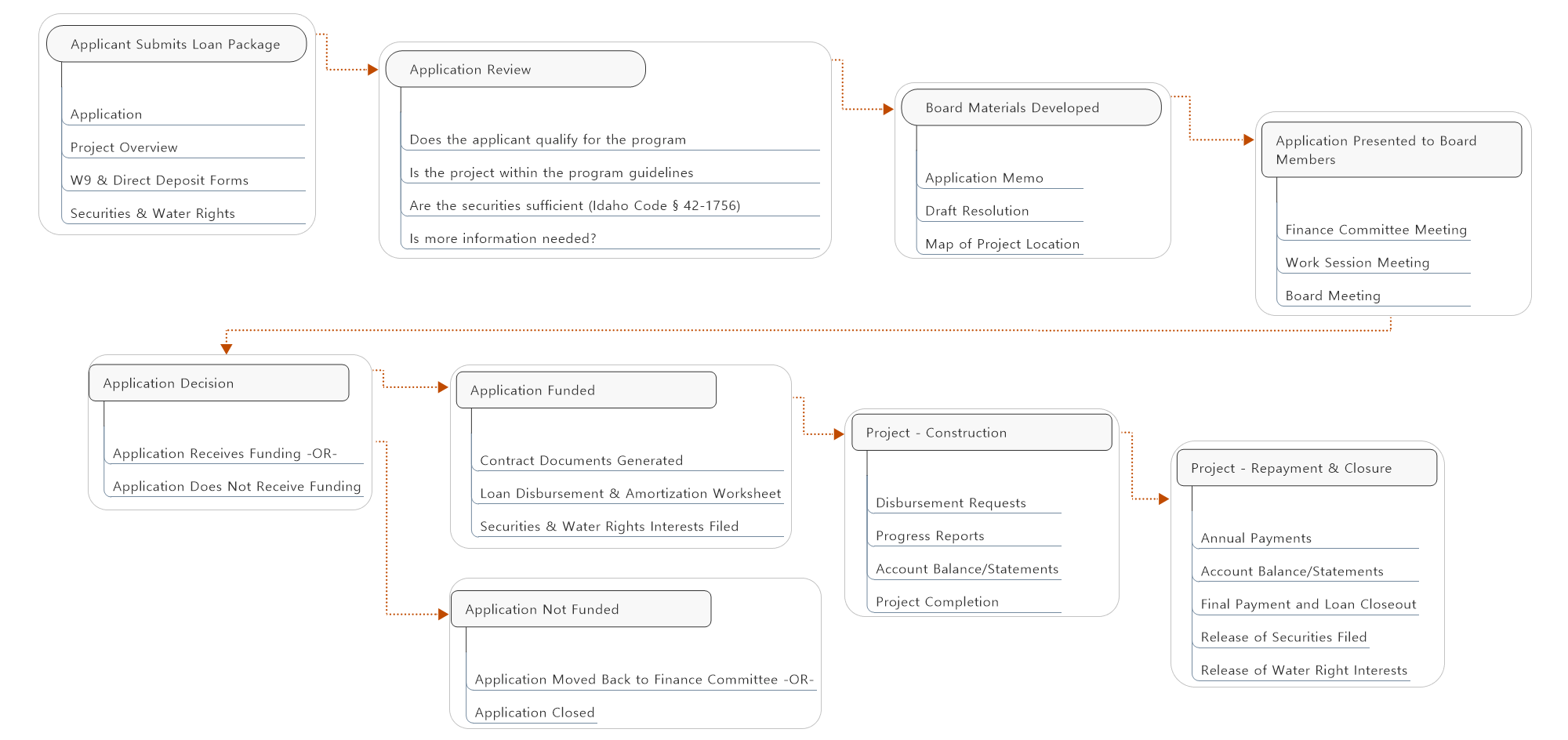

Loan Application Workflow

This account was created to financially assist, develop, and support the development of water resources of the state through the construction, rehabilitation, improvement, or extension of existing systems. The funds must be used in the public interest for the development of water projects as deemed by the IWRB. Approved funds are made available to irrigation districts, irrigation organizations, water user associations, and municipal or private corporations. In certain cases, the funds are made available to individuals for financing project costs provided that no loan given is used for feasibility studies except as part of the overall project costs.

This account was created to financially assist, develop, and support the development of water resources of the state through the construction, rehabilitation, improvement, or extension of existing systems. The funds must be used in the public interest for the development of water projects as deemed by the IWRB. Approved funds are made available to irrigation districts, irrigation organizations, water user associations, and municipal or private corporations. In certain cases, the funds are made available to individuals for financing project costs provided that no loan given is used for feasibility studies except as part of the overall project costs.

- Contact the Loan Program team to discuss the project.

- If the project falls under the guidelines, the team asks you to complete a loan form and submit it with the required documents.

- The team reviews your application and verifies your assets for securing the loan.

- The team calculates estimated cost assessments to the borrower at different terms.

- The team presents this information in a memo to the Board at their meeting.

- The board reviews the application and either approves or denies the application.

Yes, we recommended that the applicant or a representative attend the board meeting during the loan application review. Doing so aids the Board should they have any questions which fall outside the scope of the Loan Program team’s memo to the Board.

You are not required to use all funds appropriated for the loan. Funds that are not used remain in the revolving loan account. However, loan repayment is based on the funds appropriated.

You are responsible to repay the loan’s principle and accrued interest according to the repayment agreement. If you choose to repay the loan earlier than agreed, there is no “early payoff” penalty.